First-Class Check Mailing Explained: How It Works and Why It Matters

1. Introduction: Understanding the Role of First-Class Check Mailing

In today’s tech-driven world, digital payments seem to dominate the conversation. However, first-class-check-mailing remains a vital and effective tool for businesses of all sizes. Whether it’s vendor payments, customer refunds, or employee reimbursements, mailing checks through the U.S. Postal Service (USPS) provides a balance of cost, reliability, and security. Understanding how this service works—and why it continues to matter—is essential for businesses that want to operate efficiently and serve a diverse set of recipients.

Table of Contents

2. What Is First-Class Mail and How Does It Apply to Checks?

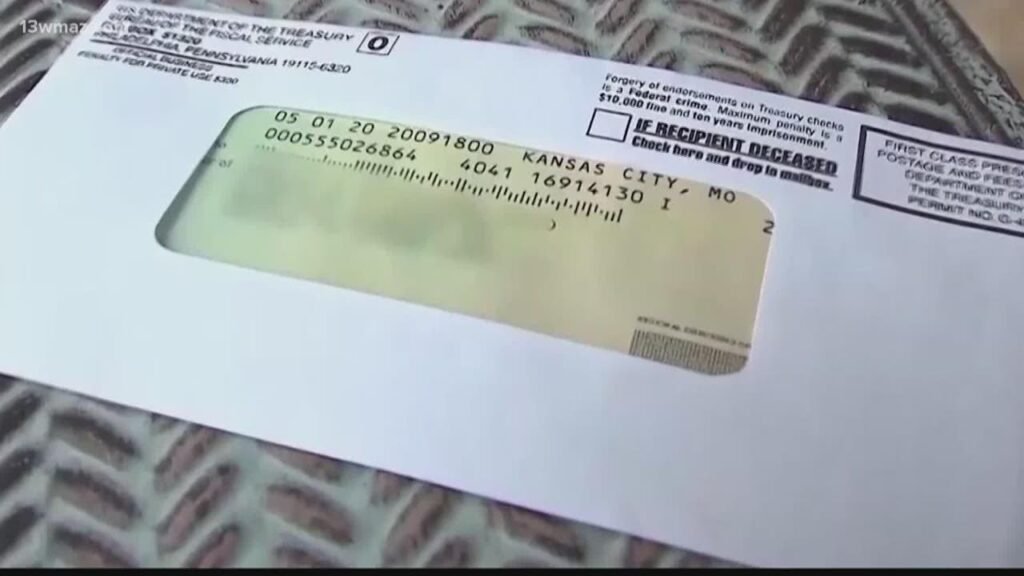

First-class mail is the standard mail service offered by USPS for letters, postcards, and small parcels. It’s the most common and economical method of sending personal and business correspondence—including checks. For checks, this means mailing them in sealed envelopes that weigh less than 3.5 ounces, ensuring they qualify for first-class postage. Delivery usually takes 1–5 business days depending on the destination. Additionally, first-class mail includes features like return service and mail forwarding, making it ideal for critical financial documents like checks.

3. The Process: From Check Creation to Delivery

The first-class check mailing process involves several steps. It begins with the generation of checks—usually through accounting or payroll software. Businesses either print these checks in-house or outsource the task to a check mailing service provider. The check is then inserted into a secure envelope—often a double-window or pressure-sealed envelope—and sent via USPS first-class mail. The delivery process is handled by USPS, with the check reaching the recipient typically within a few days. Companies may add options like Certified Mail or tracking for high-value or sensitive payments.

4. Why Businesses Still Mail Checks

Despite the rise of electronic payment systems, many businesses and industries continue to rely on check mailing for several valid reasons. Checks provide a tangible proof of payment, making them easier to track and verify. They are also widely accepted across various sectors and recipient types, from landlords and contractors to healthcare providers and nonprofits. For some transactions—such as insurance payouts, legal settlements, or government disbursements—paper checks are still a required or preferred method due to regulatory, audit, or legacy system constraints.

5. Advantages of First-Class Check Mailing

One of the key benefits of first-class check mailing is its cost-effectiveness. Compared to electronic transfers, which can incur transaction fees, sending a check by mail is often cheaper, especially for low-value or one-time payments. It also offers built-in reliability thanks to USPS’s wide coverage and return-to-sender options. Security is another advantage; physical checks include anti-fraud features like watermarks and microprinting, and can be sealed in tamper-evident envelopes. Finally, mailing checks ensures inclusivity, as recipients don’t need online banking or internet access to receive their funds.

6. Security Considerations and Best Practices

While first-class check mailing is secure, businesses must still follow best practices to protect sensitive information. This includes using secure check stock, storing blank checks in locked areas, and employing dual control procedures for printing and mailing. Envelopes should be opaque and tamper-proof, and addresses should be verified for accuracy. For added security, some companies use Certified Mail, tracking, or signature confirmation—particularly when sending high-value checks. Outsourcing to a secure check mailing service can also reduce fraud risks and improve compliance.

7. Address Accuracy and List Maintenance

Incorrect addresses are one of the most common causes of payment delays and lost checks. To prevent this, businesses must prioritize address list hygiene. This means regularly updating contact information, verifying addresses using USPS databases, and using tools like the National Change of Address (NCOA) service. Return mail should be monitored closely, and undeliverable checks should be promptly reissued or voided. A strong address verification process not only ensures timely delivery but also protects sensitive payment data from being exposed to the wrong recipient.

8. When to Use First-Class Check Mailing Instead of Digital Options

While digital payments offer speed and convenience, there are specific scenarios where first-class check mailing is the smarter or necessary choice. For instance, if a recipient doesn’t have a bank account or prefers not to share banking details, a mailed check is a practical solution. If you need to include supporting documents (like invoices or payment memos), a mailed package can provide clearer communication. Additionally, certain legal or tax-related payments must be sent by check for audit trail and compliance purposes.

9. Conclusion: The Strategic Value of First-Class Check Mailing

first-class-check-mailing isn’t just a legacy practice—it’s a strategic payment solution that continues to deliver value in the modern business world. It provides businesses with a secure, reliable, and cost-effective way to handle payments while supporting compliance, traceability, and accessibility. As financial systems evolve, the most agile businesses will be those that understand when to go digital and when to stick with the tried-and-true paper check. By mastering the nuances of first-class check mailing, companies can enhance operational efficiency while maintaining a high standard of professionalism and trust.